The concept of consumer surplus is important in economics. Consumer surplus is defined as the difference between the willingness of a consumer to pay for a product and the actual amount that the consumer ends up paying in demand to obtain the product. Consumer surplus can be positive or negative.

In short, a consumer surplus is a positive difference between the total utility from a commodity and the total payments made for it. In other words, it will be negative if the market price exceeds the customer’s willingness to pay.

Meaning and Concept of Consumer Surplus

The concept of consumer surplus is important in economic policies such as taxation by the government and price policy pursued by the monopolist seller of a product. The essence of the concept of consumer surplus is that a consumer derives extra satisfaction from the purchases he daily makes than the price he pays for them.

This extra satisfaction, which the consumer obtains from buying a good, has been called consumer’s surplus by Marshall.

When there is a difference between the price that you pay in the market and the value that you place on the product, then the concept of consumer surplus becomes a useful one to look at. This is an important idea you can use often in your exams.

Consumer surplus formula and Examples

Formula:

The consumer surplus formula can be represented as follows:

1. Consumer surplus = Potential Price – Actual price.

2. Consumer surplus = Maximum price buyer is willing to pay – Actual price.

3. Consumers Surplus = Total Utility – (Total units purchased x marginal utility or price)

For Example:

Suppose, a student goes to buy a book. He is willing to pay Rs. 20 for the book. But he gets the book for Rs. 15. Thus, he has saved Rs. 5. This is called Consumer’s Surplus.

Definitions of Consumer Surplus

The actual definitions of consumers surplus are defined by various economists, which are described as given below:

1. According to Prof. Marshall, “The excess of price which he (consumer) would be willing to pay rather than go without. The thing over that, which he does pay, is the economic measure of this surplus satisfaction. It may be called “Consumer’s Surplus”.

2. According to Penson, “The difference between what we would pay and what we have to pay is called Consumer’s Surplus.”

3. Prof. Samuelson defines consumer surplus as “The gap between the total utility of a good and its total market value is called consumer’s surplus.”

Assumption of Consumer Surplus

Cardinal utility, that is, the utility of a commodity is measured in money terms. Marshall assumes a definite relationship exists between expected satisfaction (utility) and realized satisfaction (actual).

The marginal utility of money is constant.

Absence of differences in income, tastes, fashion, etc.

Independent goods and independent utilities.

Demand for a commodity depends on its price alone;

it excludes other determinants of demand.

No Close Substitutes Available: The commodity in question has no close substitutes and if it does have any substitute, the same may be regarded as an identical commodity and thus only one demand should be prepared.

Tastes and Incomes are the same: All people are of identical tastes, and fashions and their incomes also are the same.

Explain the law of consumer surplus with Diagrams

The above definition of Prof. Marshall can be explained with the help of practical examples:

Consumer’s Surplus when there is a single purchase and

Consumer’s Surplus when there are multiple unit purchases.

1. Consumer Surplus on Single Unit Purchase: When a consumer purchases only one unit of a commodity even then the Consumer Surplus arises. Let us suppose a student is willing to pay Rs. 30 for a particular book and when he goes to market and purchases it at Rs. 25. Thus Rs. 5 (30-25) is the Consumer’s Surplus.

2. Consumer’s Surplus on a Multi-unit Commodity: In our real life one purchases several units of a particular commodity. The price that a consumer pays for all the different units of a commodity measures the utilities of the marginal sit and he pays the same price for different commodities.

The excess of utilities is derived from different commodities and the actual price paid is called Consumer’s Surplus Let us take an example of a person whose marginal utility, price, and Consumer’s Surplus schedule for sweets is given in the following table:

| Units of Bread | Marginal Utility | Price(in Rs) | Consumers Surplus (in Rs) |

| 1 | 10 | 2 | 8 |

| 2 | 8 | 2 | 6 |

| 3 | 6 | 2 | 4 |

| 4 | 4 | 2 | 2 |

| 5 | 2 | 2 | 0 |

| 6 | 0 | 2 | -2 |

The above table expresses the various amounts of utilities he derives from the consumption of different units of sweets. From the first sweets alone he derives a marginal utility of Rs. 10 but the price which he pays is Rs. 2 and hence Rs. 8 is the Consumer’s Surplus. Similarly, the Consumer’s Surplus from the 2nd, 3rd, 4th, and 5th units are 6, 4, 2, and zero respectively.

A rational consumer will consume only the 5th commodity where the marginal utility is equal to its price and thereby maximizes his Consumer’s Surplus. If he will consume the 6th unit he derives zero marginal utility whereas he pays the price as Rs. 2. A rational consumer will not consume that commodity.

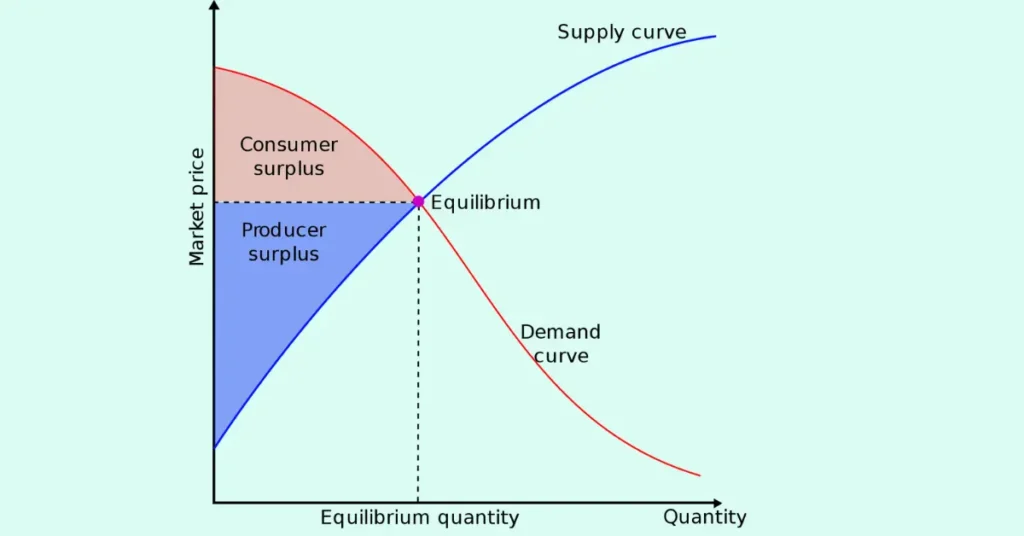

Diagrammatic Representation of Consumer Surplus

In Figure, DD’ is a consumer demand curve OP is the market price. The price line is parallel to the X-axis because of perfect competition. At point “M’ the marginal curve DD intersects the market price curve. Thus for OQ quantity the consumer derives utility as DOOM where as he pays POQM. Thus, triangular shaded area DPM is Consumer’s Surplus.

Fig : Diagrammatic Representation of Consumer Surplus

Consumer surplus= Total Utility – (Number of goods purchased *Price).

In case you missed it: Entrepreneurship Development Programme

Importance of Consumer Surplus

Economists think that the actual measurement of Consumer Surplus is a difficult task as utility is purely a psychological concept, yet the concept has great practical importance.

1. The distinction between value-in-use and value-in-exchange:

Consumer Surplus points to the distinction between the use value and the exchange value of a thing. Commodities like salt and match-box have great value in use but much less value in exchange. Being necessaries and cheap things they yield, however a large Consumer Surplus. The Consumer’s Surplus depends on total utility, whereas the price depends on marginal utility.

2. Comparison of gains from international trade:

Consumer Surplus from international transactions enables us to compare the relative gains from the international trade of the different countries. For example, we can import things cheaply from abroad, but before importing, we were paying more for similar home-produced goods. The imports, therefore, yield a surplus satisfaction. This is Consumer’s Surplus. The larger this surplus, the more beneficial international trade.

3. Useful to businessmen and monopolists:

It is of practical importance to monopolies and businessmen in fixing the price of their commodities. If the commodity is such that the consumers are willing to pay more for it, they will enjoy a large surplus. In such a case the monopolist and businessman can raise the price without affecting the sale. Thus, the monopolist and businessman are guided by the knowledge of the Consumer’s Surplus in fixing the price of his product.

4. Comparing advantages of different places:

Consumer Surplus proves useful when we compare the advantage of living in two different places. A place where there are greater amenities available at cheaper rates will be better to live in. In these places, the consumers enjoy a large surplus of satisfaction. Consumer Surplus thus indicates environmental and conjectural advantages i.e., the advantages of the environment and opportunities.

Importance in public finance: The concept has great practical importance to the Government in determining the desirability of imposing a tax on certain commodities. A tax imposed on a commodity tends to raise its price and to reduce Consumer Surplus thereby, but it yields some revenue to the government. The Finance Minister is to compare the Loss of Consumer surplus to the increase in tax revenue. A tax is justified when the loss in Consumer Surplus becomes less than the increase in tax revenue, otherwise, it will be harmful.

5. Cost-Benefit Analysis:

The concept of consumer surplus is very useful in the cost-benefit analysis of investment done on a bridge, dam, railway, park, canal, etc. In decision-making for such projects, expected consumer surplus is an important factor. In cost-benefit analysis, cost and benefit mean not only money cost and money profit but also real cost and real profit in terms of resources and satisfaction.

This analysis is related to social profit and social cost. For example, the profit from government projects such as bridges is estimated from the expected saving of time by all the visitors using the new bridge, and of the cost of fuel used by the car owners. The concept of cost-benefit is derived from the concept of consumer surplus. The consumer surplus is a personal profit that is received by the project’s users.

6. Effect of a tax on consumer’s surplus:

A tax on a commodity raises its price and reduces the consumer’s surplus. But it brings revenue to the state. Therefore, a tax is justified only if the gain in state revenue is greater than the loss in consumer surplus. However, the effect on price and hence on consumer surplus will differ according to the industry operating under the law of increasing returns, diminishing returns, or constant returns.

7. Importance in welfare economics:

This can be explained in the following manner (1) In his partial analysis. Marshall deals with the surplus of all the consumers in a market. (ii) Next, the effects of price-quantity variations of commodities on the welfare of the commodity are also being worked out with the aid of this concept. (iii) Further, the gain which accrues to the community from a new product and the loss from the total disappearance of a product from the market are some of the other problems which are being explained with the idea of Consumer Surplus. (iv) In the end, the effects of a tax and a subsidy on total welfare can be explained by

8. Effects of a Subsidy on Consumer’s Surplus:

Subsidy or bounty is the monetary help given by the state to reduce the high cost of production so that it may be possible for the producer to sell his commodity at a lower price and thus push his sales. A subsidy is justified only if the gain in the consumer’s surplus is greater than the loss to the state.

In case you missed it: Definition, Nature, And Scope Of Agricultural Economics

Limitations of Consumer Surplus

The concept of Consumer Surplus has been criticized on several grounds:

- It is difficult to measure the marginal utilities of different units of a commodity consumed by a person. Hence, the precise measurement of consumer surplus is not possible.

- For necessary goods, the marginal utilities of the first few units are infinitely large. Hence the consumer’s surplus is infinite for such goods.

- It assumes that consumers always have complete information about the market, which is often not the case.

- It does not take into account the distribution of surplus among consumers, which may not be equal.

- It assumes that consumer preferences are static, which may not be true as preferences can change over time.

- It does not consider the possibility of market power, which can result in firms charging higher prices than what would be considered fair.

- It does not account for externalities, which can affect the overall welfare of consumers and society as a whole.

- It assumes that consumers are rational and always make decisions based on their best interests, which is not always the case.

Consumer Surplus and Price Elasticity of Demand

How is consumer surplus affected by the elasticity of a demand curve? When the demand for a good or service is perfectly elastic, consumer surplus is definite because the price that people pay matches exactly what they are willing to pay. In contrast, when demand is perfectly inelastic, consumer surplus is infinite, In this situation, demand does not respond to a price change.

Whatever the price, the quantity demand remains the same. Are there any examples of products that have such zero price elasticity demand? Perhaps the closest we get is a life-saving product with no obvious substitutes – in this situation; consumers’ willingness to pay will be extremely high.

The majority of demand curves in markets are assumed to be downward sloping. When demand is inelastic, there is a greater potential consumer surplus because some buyers are willing to pay a high price to continue consuming the product. Businesses often raise prices when demand is inelastic so that they can turn consumer surplus into producer surplus!

Consumer Surplus and Price Discrimination

Producers often take advantage of consumer surplus when setting prices. If a business can identify groups of consumers within their market who are willing and able to pay different prices for the same products, then sellers use price discrimination. This is a way of turning consumer surplus into producer surplus to make higher revenue and profits.

Airlines and train companies are experts at this, extracting from consumers the price they are willing and able to pay for flying to different destinations are various times of the day, and exploiting variations in the elasticity of demand for different types of passenger service. If you are prepared to book in advance, you will always get a better deal or price with airlines such as EasyJet and Ryan Air.

The airlines are happy to sell tickets more cheaply because they get the benefit of cash flow together with the guarantee of a seat being filled. The nearer the time to take off, the higher the price. If a businessman is desperate to fly from Newcastle to Paris in 24 hours, his or her demand is said to be price inelastic and the corresponding price for the ticket will be much higher.

Consumer Surplus and Producer Surplus Concept

The economic terms used to define market health by studying the relationship between consumers and suppliers are consumer surplus and producer surplus.

The consumer surplus relates to the differences in what consumers are prepared to pay for a product and what they will pay for it.

The surplus is the difference between market prices and those that a producer would be prepared to accept as an acceptable price for producing goods.

Consumer surplus is described by the distinction between the payment made by a consumer and the amount the consumer would have been ready to repay.

On the other hand, producer surplus describes the difference connecting the price a company obtains and the price it would be prepared to vend it at.

FAQs

Q. What is the consumer surplus formula?

The consumer surplus formula can be represented as follows: Consumer surplus = Potential Price – Actual price.

Q. Why is the consumer surplus important?

Because Consumer surplus is important in determining economic welfare and is influenced by the price elasticity of demand and price discrimination strategies employed by firms.

Q. What are the consumer surplus examples?

The example of consumer surplus is Suppose, a student goes to buy a book. He is willing to pay Rs. 20 for the book. But he gets the book for Rs. 15. Thus, he has saved Rs. 5. This is called Consumer’s Surplus.

Q. What is a surplus in simple words?

The extra satisfaction, that the consumer obtains from buying a good, has been called consumer’s surplus

Conclusion

Consumer surplus is a measure of the benefit or satisfaction that consumers receive from purchasing a good or service. The concept of consumer surplus is based on certain assumptions, such as perfect information and rational behavior by consumers. The law of consumer surplus states that as the price of a good or service decreases, the consumer surplus increases. However, there are limitations to the concept, including the difficulty in measuring consumer preferences accurately. Consumer surplus is important in determining economic welfare and is influenced by the price elasticity of demand and price discrimination strategies employed by firms.

Nice